If you’re not involved in real estate or the market, you may not have heard about the National Association of Realtors (NAR) settlement. Whether you’re looking for information or just want to impress at a dinner party, here’s what you need to know and how the settlement might impact you.

Some Context

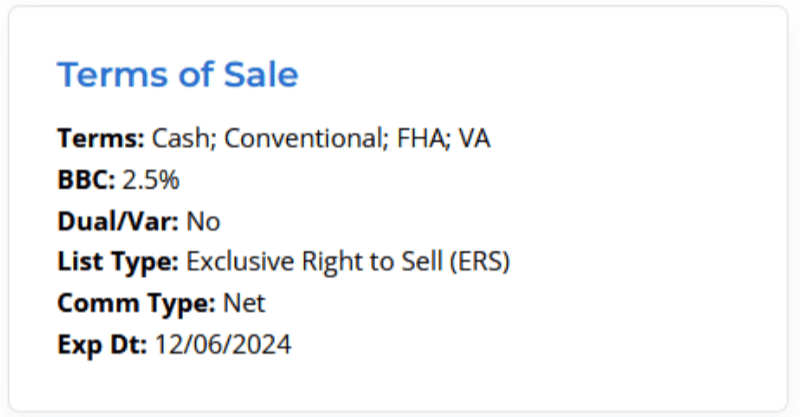

Generically speaking, in real estate transactions, the seller and seller’s agent determine how much the buyer’s agent would be paid. At least in Utah, this was advertised directly in the listing as BAC (Buyer Agency Commission) or BBC (Buyer Brokerage Compensation). The commission was paid through the seller’s escrow proceeds in a lump sum (a percentage of the agreed sales price).

Example: If BAC/BBC was advertised as 3% and the home sale price was $100,000, then the buyer’s agent would receive $3,000 in commission, and the seller’s agent would also receive $3,000 through closing.

2019 – 2024

- Multiple class action lawsuits were brought against the NAR and several large franchise brokers. All these cases had in common plaintiff allegations that the NAR rules related to the disclosure of commissions in the MLS (Multiple Listing Service aka UtahRealEstate.com) artificially inflated home prices, hurting buyers and sellers.

- One of the most significant cases went to trial, and the jury agreed with the plaintiffs, then NAR and several of the large brokerages agreed to settlements.

- March 2024 – NAR agreed to pay over $400M to plaintiffs, intended to compensate sellers who may have been overcharged due to the alleged commission structure. NAR also determined some rule changes to be implemented by MLS’ across the country.

Changes From the Settlement

1. Offers of compensation will be prohibited on the MLS and third-party products.

- This is the part of the listing that says BBC: #% or BAC: #%. This stands for Buyer Agency Commission or Buyer Brokerage Compensation – this previously advertised that the seller is willing to pay the buyer’s agent the commission listed.

- Additional NAR Rule: This change also prohibits including a $ or % amount in the Concessions section of what the seller would be willing to pay the buyer to be used for commissions.

2. Realtors must have a written agreement with terms before showing homes to buyers.

- This will be one of the most significant practice changes for many realtors/agents. Before even touring a home, you must have a Buyer Broker Exclusivity agreement signed, including how much the buyer will pay the agent in commission. In many cases, before the settlement, this was signed when creating an offer, and the commission advertised on the MLS was put into the agreement. Effectively, the seller fulfilled the buyer’s obligation to pay the commission.

3. Commissions paid on sold listings cannot be disclosed.

4. Realtors cannot filter or restrict listings provided to clients based on compensation or broker/agent name.

- This change is aimed at ensuring that all listings are presented fairly and equitably to clients, without bias based on potential commissions or affiliations.

5. NAR members are prohibited from participating in multi-brokerage commission-sharing platforms

- Multi-brokerage platforms are agreements where real estate brokerages collaborate to set or share standard commission structures. These practices are seen as anti-competitive because they restrict independent negotiation of commission rates, reducing competition and potentially raising costs for consumers. The NAR’s new rule prohibits participation in these platforms to promote more competition and transparency in the commission setting, benefiting both buyers and sellers.

Myth Busting and What to Expect

Commission is Negotiable (and always has been)

One common misconception is that this settlement is allowing for commission negotiation. Let’s be clear – commission is and was always negotiable, even before this settlement.

One more time for the people in the back – commission is always negotiable!

Now, you may have been in a situation where your agent refused to budge on how much they were getting paid. That may be a personal standard, it may be that their brokerage requires them to charge a specific rate. But generally speaking, it is always negotiable.

Sellers Offering No or Low Compensation

It is very uncommon for a seller to offer no or low compensation to the buyer’s agent, although technically they have always had this option. One of the main reasons is that offering compensation from the seller allows buyers to compete more aggressively. So this system has really served both sides.

For Sellers

As the seller, you and your agent will make the final selection from submitted offers. But the true price of a home is determined by what buyers are willing to propose in the current market. One perspective on commissions is that buyers inherently cover these costs through the final price, particularly when using financing, as the commission becomes part of their mortgage rather than an immediate expense. Though some buyers have the means to increase their cash investment, the absence of a cooperative commission between parties effectively reduces the purchasing capacity for the buyers and influences their ability to maximize their offer amount.

For Buyers

Complexities in the purchasing process creates possibilities for knowledgeable buyers and their representatives. In times of rising interest rates, we saw buyers gain the upper hand. This shift might push some agents out of the industry, along with buyers who are less confident or knowledgeable. More than ever this is a time when you want to work with knowledgeable agents, keep you informed, and have your best interest at heart.